44 what is the coupon rate

Budget Car Rental Coupons Budget Car Rental Coupons Save up to 10% on low rates. B112100. Up to 25% OFF Base Rates + up to 10% Donated. Save up to 25% on your car rental base rate and up to 10% of your base rate will be donated to Susan G Komen® for breast cancer research. R899700. Weekly Car Rental Deal. Save up to 10% on Rentals of 5 Days or More. D111800 What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium.

Coupon Rate - What it is, Formula, & Example - Speck & Company A coupon rate is the percentage value of that cash payment relative to the face value of the bond. For example, say we had a bond with a face value of $1,000 and it paid us an annual coupon of $25. The coupon for this bond would be $25/year while the coupon rate would be $25/$1,000 or 2.5%. The coupon rate is the percentage value.

What is the coupon rate

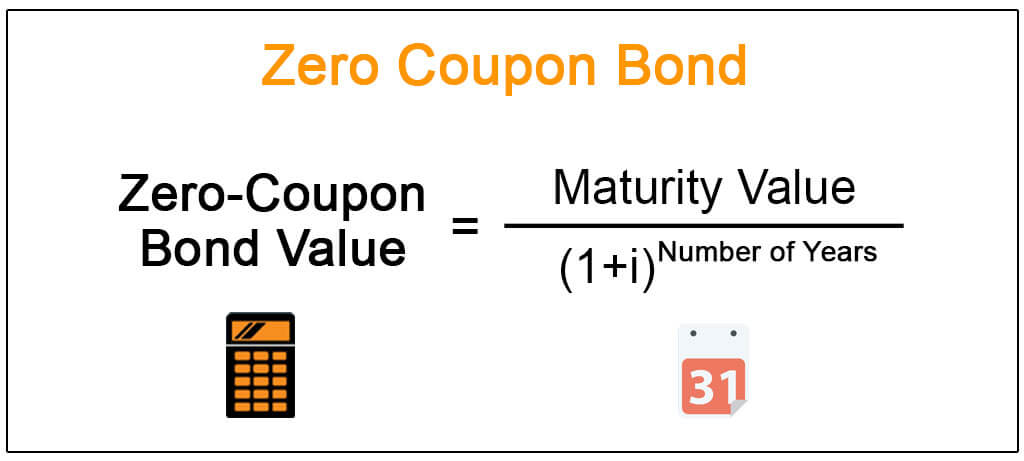

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ... Of coupons, yields, rates and spreads: What does it all mean? Key takeaways. A coupon is a fixed cash payment the investor is promised on a bond, usually expressed as a percent of the par value - which is also known as the principal.; Yield and rate of return are both dynamic values that describe the performance of a bond over a set period of time. While the rate of return on an investment is the percentage increase over the initial investment cost, a ... Coupon Rate | Definition | Finance Strategists Coupon Rate Definition. A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

What is the coupon rate. Car Rental Coupons for Discount Rental Cars | Avis Car Rental Save 10% on already LOW RATES at your neighborhood locations K348200 Up to 25% off base rates with 5% donated to Susan G. Komen® A349300 Up to 25% off base rates with 5% donated to Make A Wish® H749900 AARP members save up to 30% off base rates A359807 Up to 25% off base rates for veteran and military family T765700 Coupon Rate of a Bond (Formula, Definition) | Calculate ... Coupon Rate is referred to the stated rate of interest on fixed income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities such as bonds. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds. Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

What Is Coupon Rate and How Do You Calculate It? The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. Floating Rate Bonds: Characteristics, Rate, and Important Floating Rate Bonds offer certain benefits to both investors and issuers against the traditional fixed-rate bonds. Investors’ coupon payments adjust with changes in interest rates; As the floating rate is a combination of the Fed rate or LIBOR, it eliminates the volatility risk for investors Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less ... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Coupon Statistics - 2022 Update | Balancing Everything These coupon facts can help businesses reach higher average coupon redemption rates and step up their marketing game. (Valassis) 19. Over 80% of people from any income group look for coupons. American shoppers from any income group want to snatch the best shopping deals. Any of the income groups note high coupon redemption rates and lots of users. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

MarketWatch: Stock Market News - Financial News - MarketWatch

What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

What Is a Coupon Rate? How To Calculate Them & What They're Used For Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. For instance, say a bond has face value of $2000 and a coupon rate of 10%. Therefore, it pays $200 every year no matter what ...

Difference Between Coupon Rate and Discount Rate Coupon Rate vs Discount Rate. The main difference between the Coupon rate and the Discount rate is that a Coupon rate alludes to the rate which is determined on the face worth of the security, i.e., it is the yield on the proper pay security that is generally affected by the public authority set Discount rates, and it is usually settled by the backer of the guards while Discount rate alludes ...

Coupon Rate | Investor.gov Coupon Rate. The interest rate on a bond. It is expressed as a semi-annual rate. Featured Content. Investing Quiz - January. Test your knowledge on margin trading, ESG, index funds, and more! Top 10 New Year's Investing Resolutions. Consider including investing resolutions as part of your plan for the New Year!

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Jun 27, 2021 · Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "44 what is the coupon rate"