42 what is bond coupon rate

COCA-COLA CONSOLIDATED INC. Bond | Markets Insider The Coca-Cola Consolidated Inc.-Bond has a maturity date of 11/25/2025 and offers a coupon of 3.8000%. The payment of the coupon will take place 2.0 times per biannual on the 25.05.. MICROSOFT CORP.DL-NOTES 2017(17/57) Bond - Insider The Microsoft Corp.-Bond has a maturity date of 2/6/2057 and offers a coupon of 4.5000%. The payment of the coupon will take place 2.0 times per biannual on the 06.08.. At the current price of 107 ...

What Are Bond Funds? - fool.com Some bond funds specialize in junk bonds, or bonds issued by corporations with low credit ratings. These have higher coupon rates, but they also come with more risk.

What is bond coupon rate

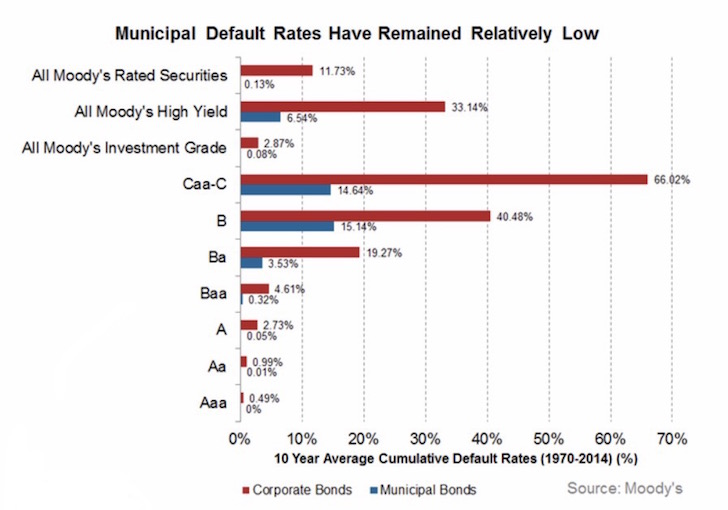

U.S. Treasury Bond Overview - CME Group Time & Sales. Specs. Margins. Calendar. US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. Australia Government Bonds - Yields Curve The Australia 10Y Government Bond has a 3.637% yield. 10 Years vs 2 Years bond spread is 49.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.85% (last modification in August 2022). The Australia credit rating is AAA, according to Standard & Poor's agency. Bonds - MunicipalBonds.com What are municipal bonds? The Key Benefit of Municipal Bonds: Tax-Free Interest; The 5 Basic Elements of Bond Investing; Two Types of Bonds: General Obligation vs. Revenue Bonds; Risks of Bond Investing; Understanding Bond Ratings; The Safety of Municipal Bonds; Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from ...

What is bond coupon rate. BANK OF AMERICA CORP. Bond | Markets Insider Bond | Markets Insider Bank of America Corp. Bond 108.86 +0.00 +0.00% 23.08.2022 BEB Add to watchlist intraday 1w 1m 6m ytd 1y 3y 5y max Indicators Mountain-Chart Date More Bonds of Merrill Lynch... Variable rate bond definition — AccountingTools What is a Variable Rate Bond? A variable rate bond is a bond whose stated interest rate varies as a percentage of a baseline indicator, such as the prime rate . Jumps in the baseline indicator can lead to substantial increases in interest rates, so this is a riskier form of financing for the issuer. Singapore Government Bonds - Yields Curve The Singapore 10Y Government Bond has a 2.810% yield. 10 Years vs 2 Years bond spread is 15.8 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.56% (last modification in July 2022). The Singapore credit rating is AAA, according to Standard & Poor's agency. S&P 500 Bond Index | S&P Dow Jones Indices - S&P Global The S&P 500® Bond Index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap U.S. equities. Market value-weighted, the index seeks to measure the performance of U.S. corporate debt issued by constituents in the iconic S&P 500.

P162.7B raised from sale of 5.5-year retail bonds The coupon was higher than prevailing secondary market rates of 5.434 percent for outstanding five-year bonds, and 5.64 percent in the case of six-year debt paper. FEATURED STORIES BUSINESS Current Rates | Edward Jones Current Rates Our latest rates for Guaranteed Investment Certificates, bonds and other investments and loans. Find a Financial Advisor Rates-at-a-glance (as of 22-Aug-2022 ) Guaranteed Investment Certificates Rates Guaranteed Investment Certificates are issued by a CDIC-insured financial institution and pay a fixed rate for a fixed term. BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ... Time To Pay Attention To The Fixed-To-Floating Rate Securities These securities are still fixed coupons after all, but now with the move up to near 3% in the adjustment most commonly used for the floating component, more than 90% of these securities by my...

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.310% yield. 10 Years vs 2 Years bond spread is 333 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.50% (last modification in July 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.530% yield.. 10 Years vs 2 Years bond spread is -9.9 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 10.05 and implied probability of ... (Get Answer) - A ?$2000 Treasury bond with a coupon rate of ?3.4% that ... erun:yes'> Basics of Statistics: A $2000 Treasury bond with a coupon rate of 3.4% that has a market value of $1625 Calculate the current yield on the described bond. WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 128.96...

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.293% yield. 10 Years vs 2 Years bond spread is 61 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

AMAZON.COM INC.DL-NOTES 2017(17/27) Bond - Insider The payment of the coupon will take place 2.0 times per biannual on the 22.02.. At the current price of 98.7 USD this equals a annual yield of 3.56%. The Amazon.com Inc.-Bond was issued on the 8 ...

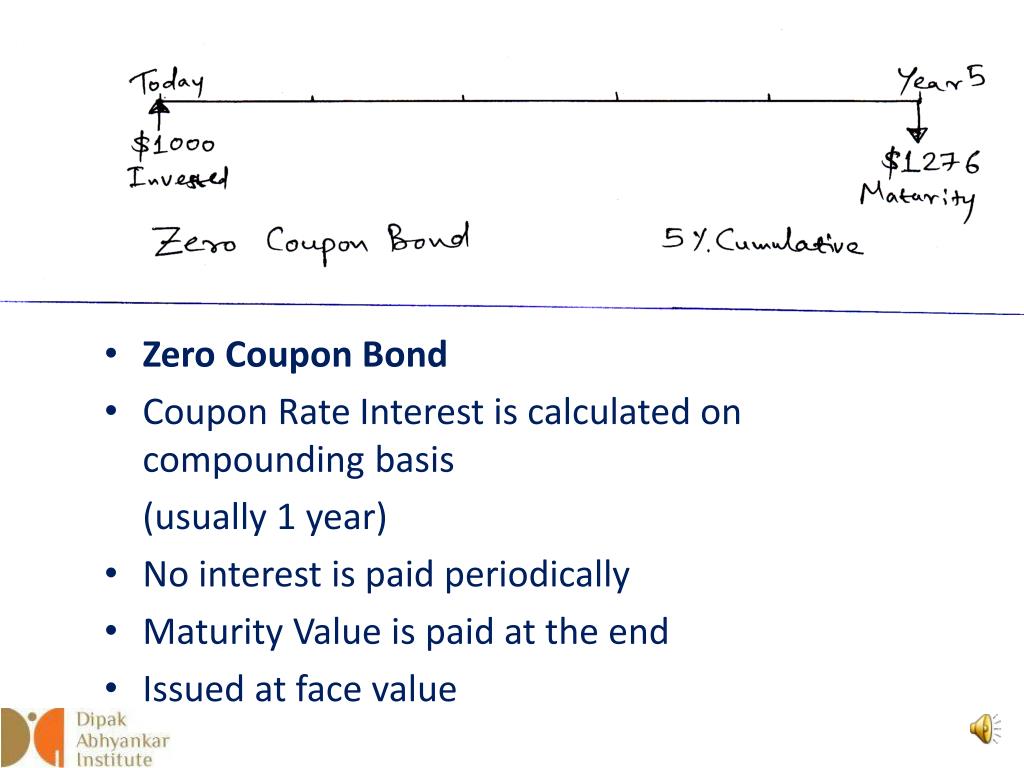

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 2 days ago, on 19 Aug 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

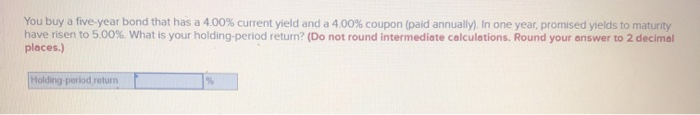

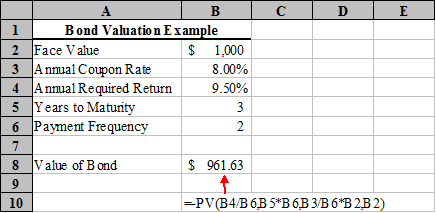

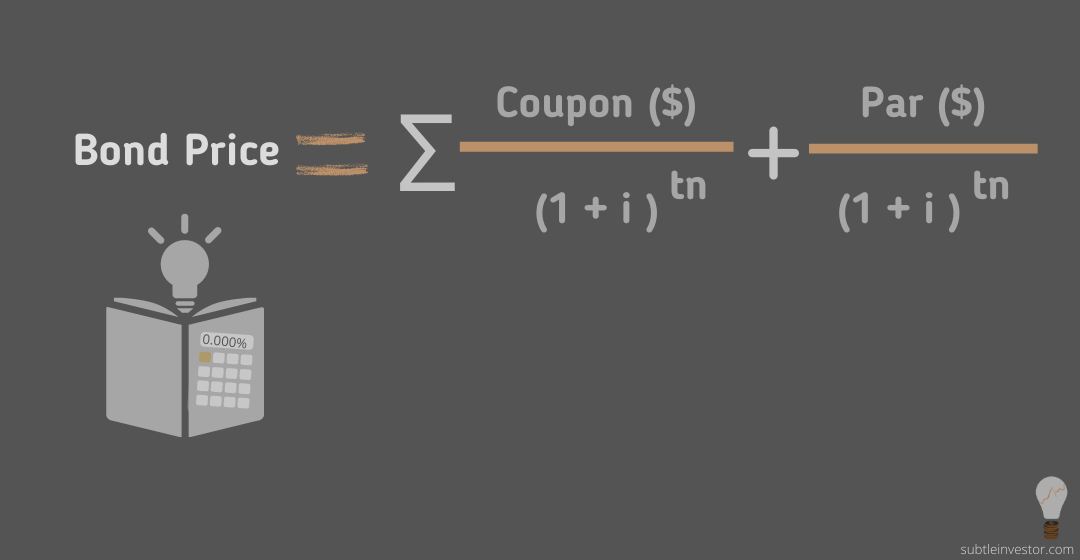

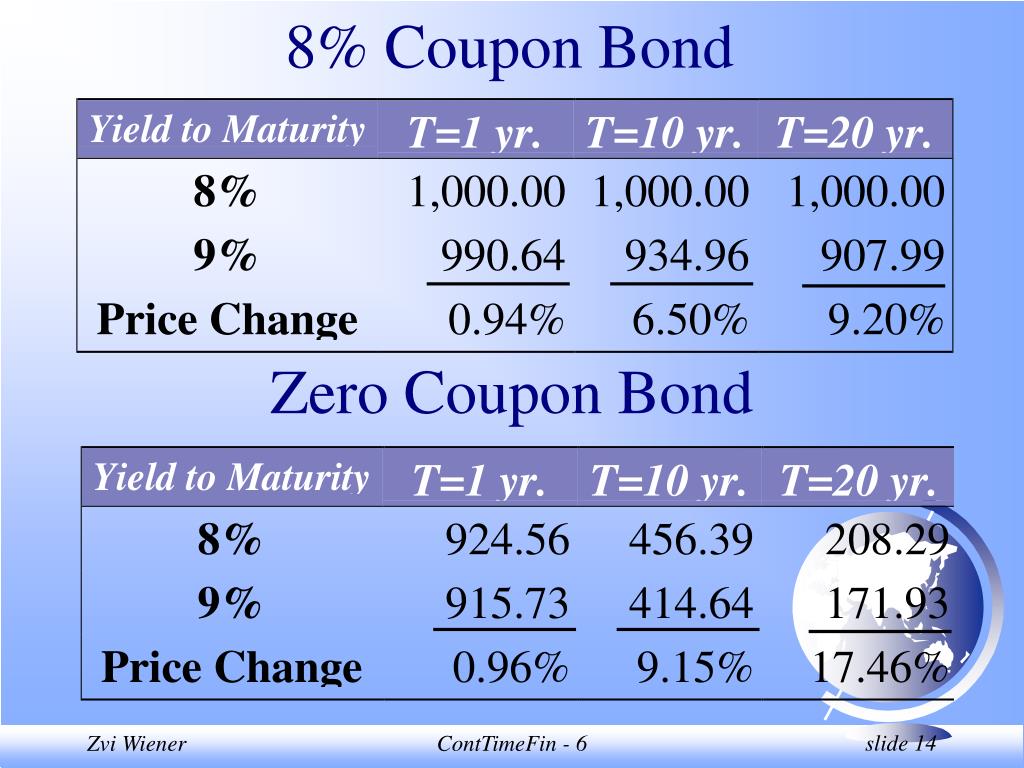

How Does an Investor Make Money On Bonds? The interest paid on a bond may be pre-set or may be based on prevailing interest rates at the time it matures. For instance, if you invested $1,000 in a 10-year bond with a coupon rate of 4%, the...

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able...

5.5-year retail bonds fetch 5.75% rate | Philippine News Agency MANILA - The coupon rate of the 5.5-year retail treasury bond (RTB) that the Bureau of the Treasury (BTr) will issue for two weeks starting Tuesday stands at 5.75 percent. Its average rate was 5.579 percent, higher than the 4.564 percent the same tenor fetched previously. The BTr offered the debt paper for PHP30 billion and the auction ...

Russia's No.1 gold producer Polyus issues bonds in Chinese yuan Polyus, the world's fourth-largest gold mining company by production volumes, said it issued five-year bonds with a coupon rate of 3.8%, planning to use proceeds from the issue for general corporate purposes and investment projects. ... Russia's largest gold producer Polyus issued bonds denominated in the Chinese yuan worth 4.6 billion yuan ...

Bonds - MunicipalBonds.com What are municipal bonds? The Key Benefit of Municipal Bonds: Tax-Free Interest; The 5 Basic Elements of Bond Investing; Two Types of Bonds: General Obligation vs. Revenue Bonds; Risks of Bond Investing; Understanding Bond Ratings; The Safety of Municipal Bonds; Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from ...

Australia Government Bonds - Yields Curve The Australia 10Y Government Bond has a 3.637% yield. 10 Years vs 2 Years bond spread is 49.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.85% (last modification in August 2022). The Australia credit rating is AAA, according to Standard & Poor's agency.

U.S. Treasury Bond Overview - CME Group Time & Sales. Specs. Margins. Calendar. US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading.

Post a Comment for "42 what is bond coupon rate"