43 coupon rate bond calculator

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Calculate bond yield to maturity - stacifaizaan.blogspot.com To calculate the current yield the formula consists of dividing the annual coupon payment by the current market price. P C1 r-1 C1 r-2. It is the amount that is payed to the. F is the Face Value of the bond.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia To further illustrate the difference between yield and coupon payments, let's consider the $1,000 bond with a 10% coupon and its 10% yield ($100 / $1,000). Now, if the market price fluctuated and...

Coupon rate bond calculator

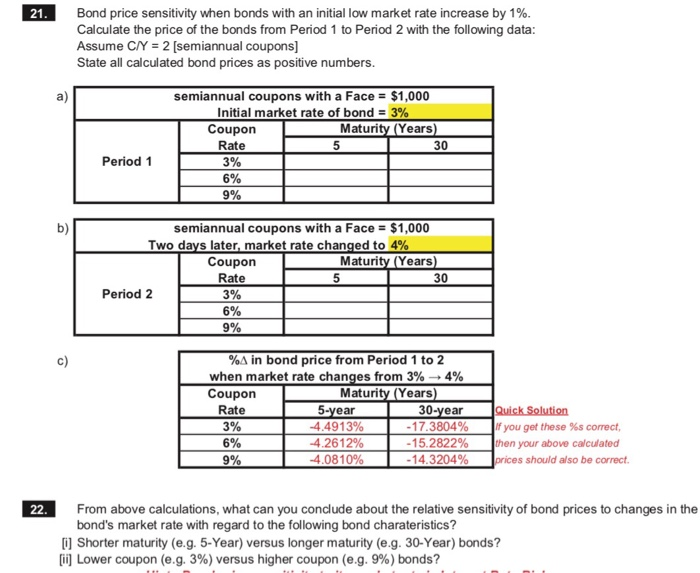

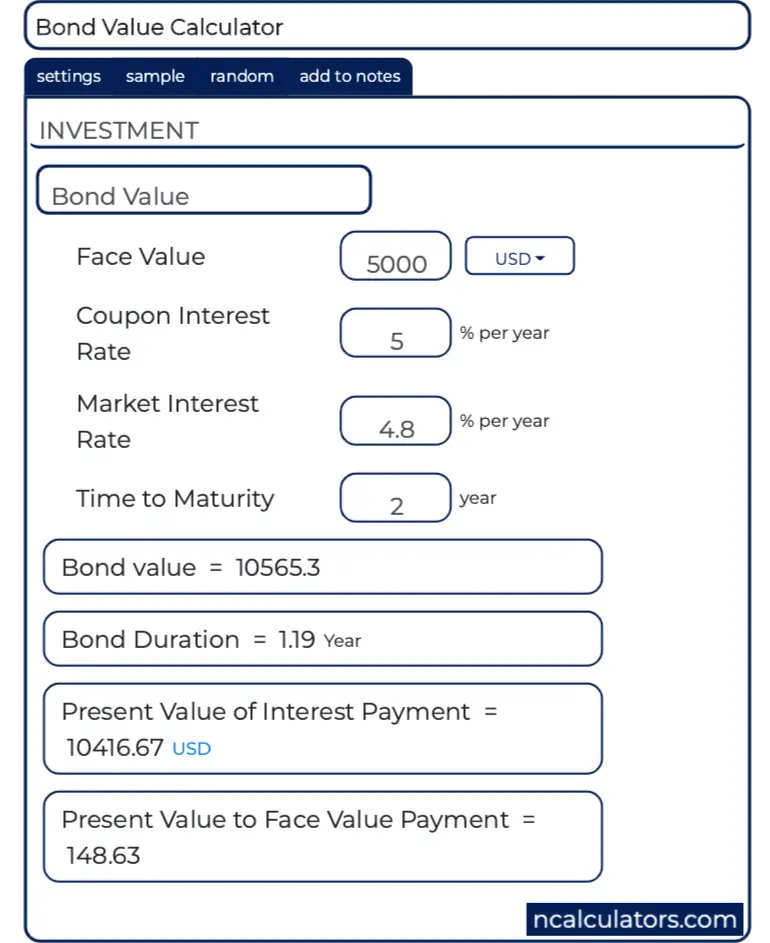

exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years XCCC - BondBloxx® ETF Overview. BondBloxx CCC Rated USD High Yield Corporate Bond ETF seeks to track the investment results of the ICE BofA CCC and Lower US High Yield Constrained Index (the "Index") which contains all bonds in the ICE BofA US Cash Pay High Yield Index (the "Underlying Index") that are rated CCC1 and lower, based on an average of Moody's Investors Services, Inc. ("Moody's"), S&P ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon rate bond calculator. Investors Need to Know This Number In Volatile Markets A bond's nominal yield represents its coupon rate or the amount of interest you can expect to earn. Knowing how to calculate nominal yield is important when evaluating bond investments. U.S. Treasury Bond Overview - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR and SOFR, and ... Bond coupon rate formula - AhranMaiya The coupon rate or coupon payment is the yield the bond paid on its issue date. For the coupon amount you would. Coupon Rate Annual Coupon Par Value of Bond. The formula to calculate the coupon rate of a bond is. Find the bond yield if the bond price is 1600. Yield to Call Calculator | Calculating YTC | InvestingAnswers To calculate a bond's yield to call, you'll need to know the: face value (also known as "par value") coupon rate number of years to the call date frequency of payments call premium (if any) current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... A $5000 bond is worth 200 times what a $25 bond is worth; a $100 bond is worth 4 times what a $25 bond is worth. If you have a $80 electronic bond at TreasuryDirect, it is worth 3.2 $25 bonds. The $25 bond value is always rounded to the nearest penny. Thus, a $5000 bond must always have a value that is a multiple of $2.00. How Do I Determine the Fair Value of a Bond? - Smart Capital Mind This little known plugin reveals the answer. To illustrate, is helps to consider a bond that has $1,000 USD par value, pays $100 coupon per year, with a 9% yield or discount rate, and will mature in three years. P = 100/ (1+0.09) + 100/ (1+0.09)^2 + 100/ (1+0.09)^3 + 1000/ (1+0.09)^3, which is equal to the fair value of $1025.31 USD. Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate Yield to Maturity Calculator | YTM | InvestingAnswers To calculate a bond's yield to maturity, enter the: bond's face value (also known as "par value") coupon rate number of years to maturity frequency of payments, and current price of the bond. How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

How to calculate yield to maturity in Excel (Free Excel Template) It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101. Fitted Yield on a 5 Year Zero Coupon Bond (THREEFY5) Graph and download economic data for Fitted Yield on a 5 Year Zero Coupon Bond (THREEFY5) from 1990-01-02 to 2022-09-09 about 5-year, bonds, yield, interest rate, interest, rate, and USA. ... -Free Three-Factor Term Structure Model and the Recent Behavior of Long-Term Yields and Distant-Horizon Forward Rates. Fitted Yield on Zero Coupon Bonds ... Zero Coupon Bonds: Calculating Price, Interest, and Value - BrainMass The bond has a coupon rate of 6.4%, pays interest annually, has a face value of $1,000, 4 years to maturity, and a yield to maturity of 7.2%. The bond's duration is 3.6481 years. You expect that interest rates will fall by .3% later today. * Use the modified duration to find the approximate percentage change in the bond's price.

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 3.136% yield. 10 Years vs 2 Years bond spread is -6.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Current 5-Years Credit Default Swap ...

› calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market.

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able...

What does it mean if a bond has a zero coupon rate? - Investopedia If interest rates go up to 6%, newly issued bonds with a par of $1,000 pay annual interest of $60, making the 4% bonds less desirable. As a result, the market price of the 4% bond drops to entice...

› blog › savings-bond-calculatorShould You Redeem Your Savings Bond? Use This Calculator to ... Jul 03, 2020 · Series EE savings bonds have a fixed interest rate (Series EE bonds issued before May 2005 may have a variable rate). Starting with a $25 bond, you can buy up to $10,000 per year online at TreasuryDirect.gov. Interest gets added to the bond monthly, and the government guarantees that the bond will double in value after 20 years. After 30 years ...

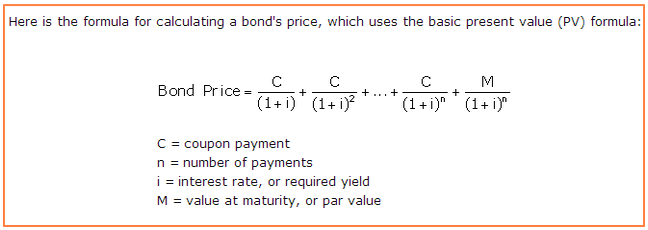

› finance › Bond-PriceBond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity

Bonds - MunicipalBonds.com What are municipal bonds? The Key Benefit of Municipal Bonds: Tax-Free Interest; The 5 Basic Elements of Bond Investing; Two Types of Bonds: General Obligation vs. Revenue Bonds; Risks of Bond Investing; Understanding Bond Ratings; The Safety of Municipal Bonds; Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from ...

33+ Bond compound interest calculator - RoyaltyVioleta An investment of 100000 at a 12 rate of return for 5 years. An I bond earns interest monthly from the first day of the month in the issue date. R r 100. The calculator performs five yield calculations. The Calculator will price paper bonds of these series. R Rate of Interest per year as a percent.

Buy I Bonds in September 2022 at 9.62% | Keil Financial Partners The September 2022 I bond inflation rate is 9.62% ( US Treasury) which is 4.81% earned over 6 months. Your $100 investment becomes $104.81 in just 6 months! We are keeping a close eye on the latest CPI-U numbers, which you will see below determine the inflation rates for I bonds. CPI numbers were released on September 13, 2022.

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... Find the price of the original bond (coupon rate = 5%, $1,000 face value, discount rate of 6%) if the term to maturity changes to: a. 2 years b. 10 years c. 30 years Price_a = {50}/ { (1.06)^1} +...

Quant Bonds - Between Coupon Dates - BetterSolutions.com Price Between Coupon Dates You can calculate the price of a bond for dates between coupon dates by 1) Using the PRICE function. 2) Using the YIELD function - uses clean price as an argument SS What is the Clean Price ? Also known as the Flat Price, Quoted Price This is the price excluding any accrued income Traders usually quote clean prices

Coupon bond formula - SpencerPearse Mathematically the coupon bond formula is represented as Coupon Bond C 1- 1 YTM -n YTM P 1 YTMn where C Coupon payment P Par value YTM Yield to. Usually the par value of the bond equals 1000. The formula to calculate a bonds coupon rate is very straightforward as detailed below.

Bond Investing For Dummies Cheat Sheet - dummies Moneychimp calculator: Here, you can put in the price of the bond, the coupon rate, and the maturity date, and out comes the all-important yield-to-maturity. How to choose between a taxable and a tax-free municipal bond.

Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market.

Nominal Yield: What It Is and How to Calculate It - SmartAsset The coupon rate of a bond is the interest rate the issuer guarantees to investors for the duration of the bond term. Coupon rates are fixed and don't change over the life of the bond. Nominal yield is also referred to as nominal bond yield, coupon yield or nominal rate. ... To calculate the nominal yield of a bond, you'll need to know two ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Zambia Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Zambia Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

XCCC - BondBloxx® ETF Overview. BondBloxx CCC Rated USD High Yield Corporate Bond ETF seeks to track the investment results of the ICE BofA CCC and Lower US High Yield Constrained Index (the "Index") which contains all bonds in the ICE BofA US Cash Pay High Yield Index (the "Underlying Index") that are rated CCC1 and lower, based on an average of Moody's Investors Services, Inc. ("Moody's"), S&P ...

exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 coupon rate bond calculator"