44 difference between yield to maturity and coupon rate

What is the difference between coupon rate and yield to maturity? Why ... Bonds are issued for a fixed term and pay a stated rate (coupon) for a stated period of time. For example $1,000 bond principal at 5% for 10 years. If you bought it at par for $1,000 and held it for maturity, you'd get $50 a year and your $1,000 principal back at maturity. Your coupon rate and yield to maturity would be the same 5%. Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Difference between yield to maturity and coupon rate

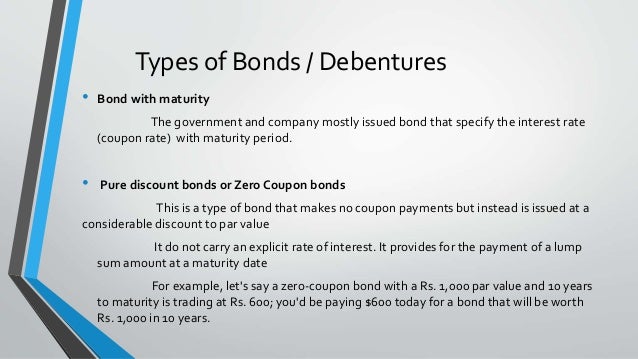

Difference between Coupon Rate And Yield To Maturity - Savart Hence in simpler words, the coupon can be referred to as the fixed amount of interest a bond will pay per annum, where the yield to maturity is the anticipated return when the bond is held till its date of maturity. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1 The coupon... What Is the Difference Between IRR and the Yield to Maturity? The bond's face value is $1,000 and its coupon rate is 6%, so we get a $60 annual interest payment. We can calculate the YTM as follows: In other words, because we bought the bond for a discount,...

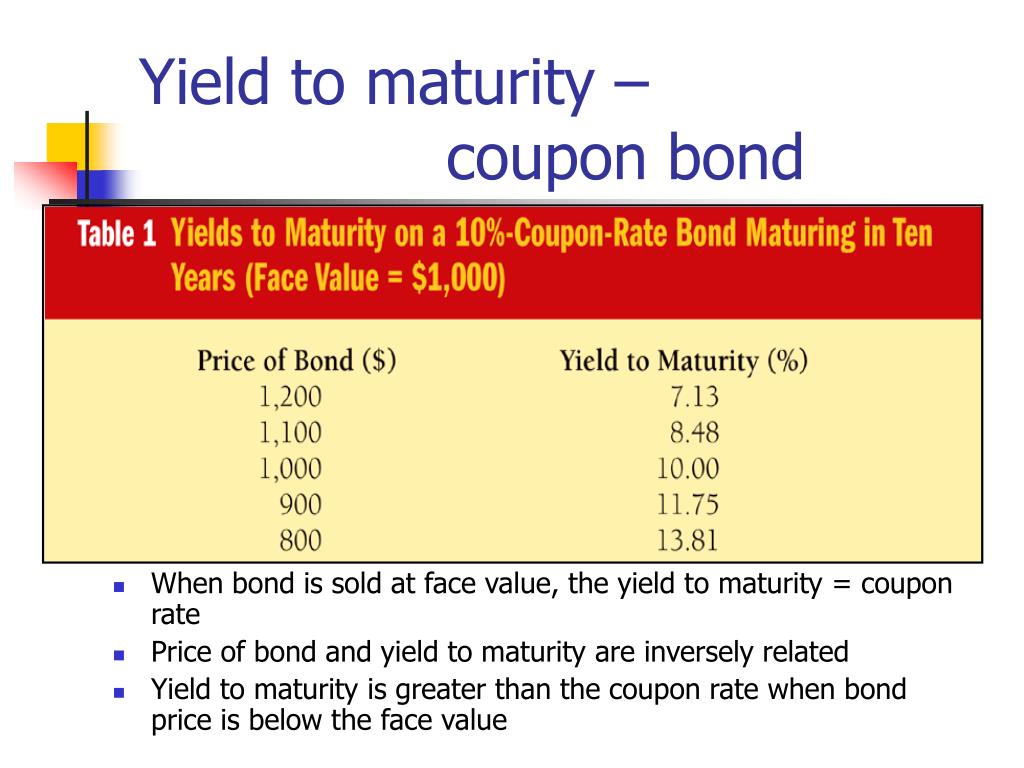

Difference between yield to maturity and coupon rate. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. The coupon rate is the annual income an investor can expect to receive while holding a particular bond. Current Yield vs. Yield to Maturity: What's the Difference? In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount. While the current yield of one bond may be more attractive, the yield to maturity of another could be substantially higher. Solved 1. What is the difference between coupon rate and | Chegg.com This bond still has exactly 5 years to maturity. This bond pays semi-annual coupon at an annual; Question: 1. What is the difference between coupon rate and yield to maturity? How do you use the coupon rate to calculate the periodic payment received from a bond? 2. What is the price of a bond that is currently trading at a yield of 10% and has ... What is Nominal Yield? - Realonomics The yield-to-maturity (YTM) is the rate of return earned on a bond that is held until maturity. To compare the effective yield to the yield-to-maturity (YTM), convert the YTM to an effective annual yield. If the YTM is greater than the bond's effective yield, then the bond is trading at a discount to par.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1. Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. Coupon Rate And Yield To Maturity - bizimkonak.com Important Differences Between Coupon and Yield to Maturity. CODES (5 days ago) Coupon vs. Yield to MaturityDo The MathSome Things to Keep in Mind When Calculating Yield to MaturityHigh-Coupon BondsYield to maturity will be equal to coupon rate if an investor purchases the bond at par value(the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As ...

Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Summary: Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ... Difference Between Yield & Coupon Rate 1.Yield rate and coupon rate are financial terms commonly used when purchasing and managing bonds. 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face value. Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

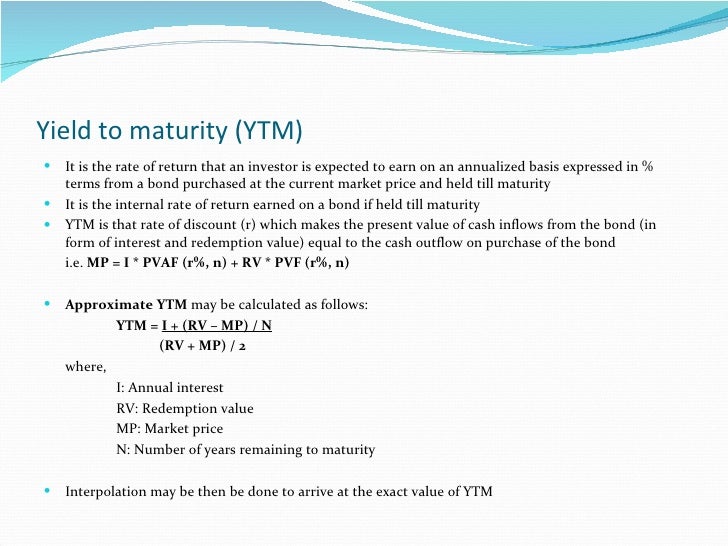

Difference Between YTM and Coupon rates YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9

How are bond yields different from coupon rate? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

Realized Compound Yield versus Yield to Maturity - Rate Return With a reinvestment rate equal to the 10% yield to maturity, the realized compound yield equals yield to maturity. But what if the reinvestment rate is not 10%? If the coupon can be invested at more than 10%, funds will grow to more than $1,210, and the realized compound return will exceed 10%. If the reinvestment rate is less than 10%, so will ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Difference Between Bond Coupon Rate And Yield To Maturity - Stag Arms USA This can be used to save on any purchases of footwear, apparel and accessories. Feel free to grab difference between bond coupon rate and yield to maturity a glass of sweet tea or a mug of hot cocoa my personal favs! Out of 59 active coupons, this is the best Personalized Ornaments For You coupons available today.

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Post a Comment for "44 difference between yield to maturity and coupon rate"