41 present value of a zero coupon bond

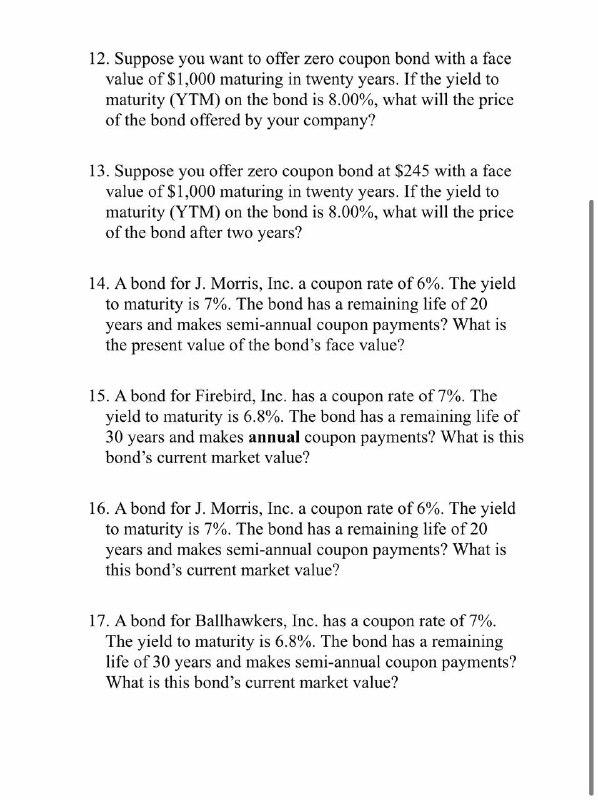

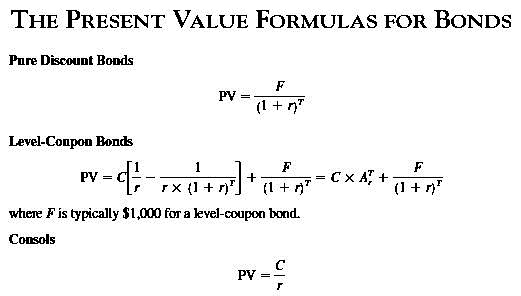

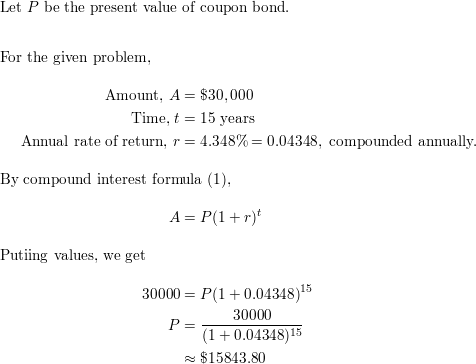

Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments. more Macaulay Duration: Definition, Formula ...

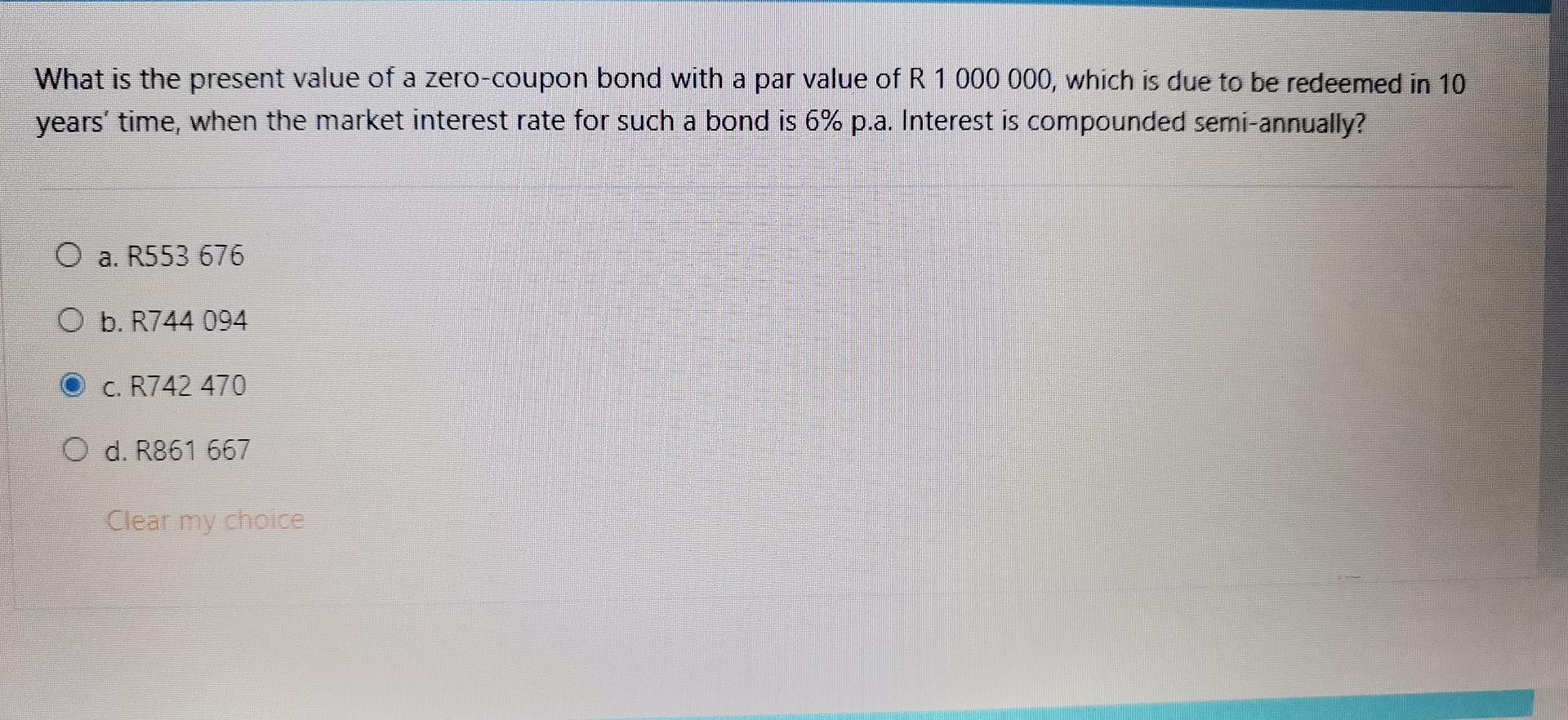

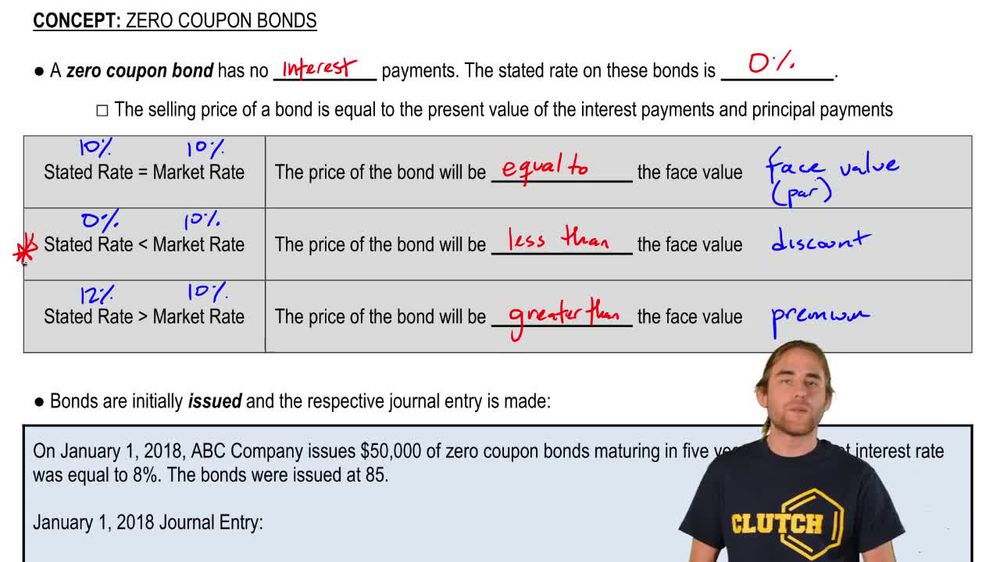

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

Present value of a zero coupon bond

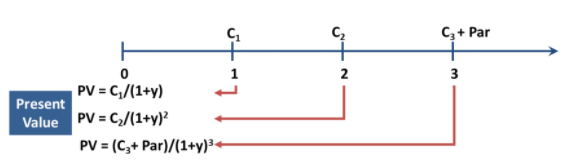

Net present value - Wikipedia Observe that as t increases the present value of each cash flow at t decreases. For example, the final incoming cash flow has a future value of 10,000 at t = 12 but has a present value (at t = 0 t = 0 (the present value) at an interest rate of 10% compounded for 12 years, which results in a cash flow of 10,000 at t = 12 (the future value). The ... Present value - Wikipedia If a $100 note with a zero coupon, payable in one year, sells for $80 now, then $80 is the present value of the note that will be worth $100 a year from now. This is because money can be put in a bank account or any other (safe) investment that will return interest in the future. Finance - Wikipedia Determining the present value of these future values, "discounting", must be at the risk-appropriate discount rate, in turn, a major focus of finance-theory. Since the debate as to whether finance is an art or a science is still open, [29] there have been recent efforts to organize a list of unsolved problems in finance .

Present value of a zero coupon bond. What Is Present Value in Finance, and How Is It Calculated? Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Finance - Wikipedia Determining the present value of these future values, "discounting", must be at the risk-appropriate discount rate, in turn, a major focus of finance-theory. Since the debate as to whether finance is an art or a science is still open, [29] there have been recent efforts to organize a list of unsolved problems in finance . Present value - Wikipedia If a $100 note with a zero coupon, payable in one year, sells for $80 now, then $80 is the present value of the note that will be worth $100 a year from now. This is because money can be put in a bank account or any other (safe) investment that will return interest in the future. Net present value - Wikipedia Observe that as t increases the present value of each cash flow at t decreases. For example, the final incoming cash flow has a future value of 10,000 at t = 12 but has a present value (at t = 0 t = 0 (the present value) at an interest rate of 10% compounded for 12 years, which results in a cash flow of 10,000 at t = 12 (the future value). The ...

Post a Comment for "41 present value of a zero coupon bond"