44 treasury zero coupon bond

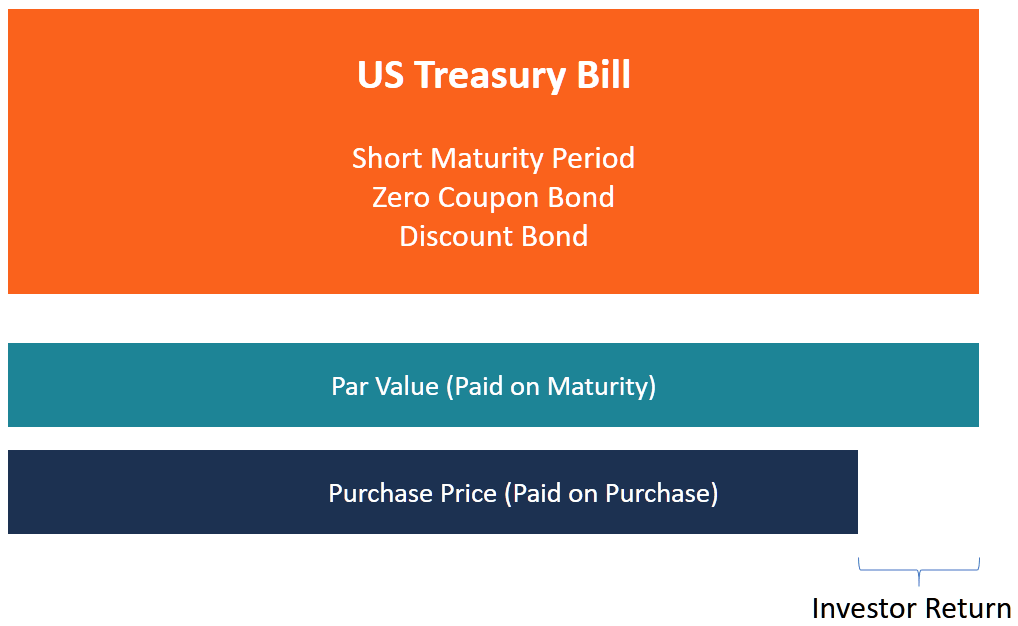

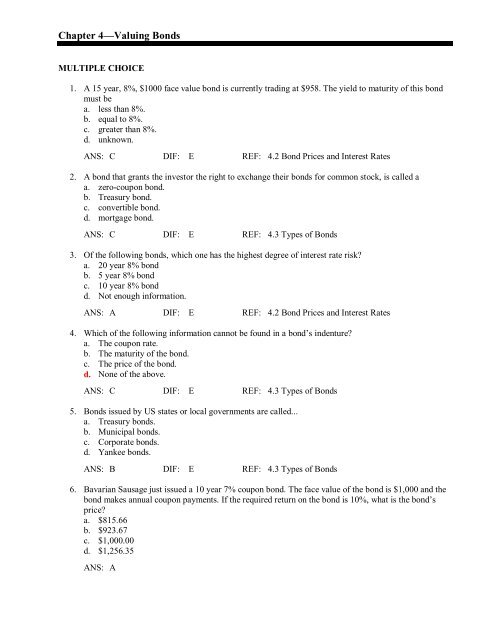

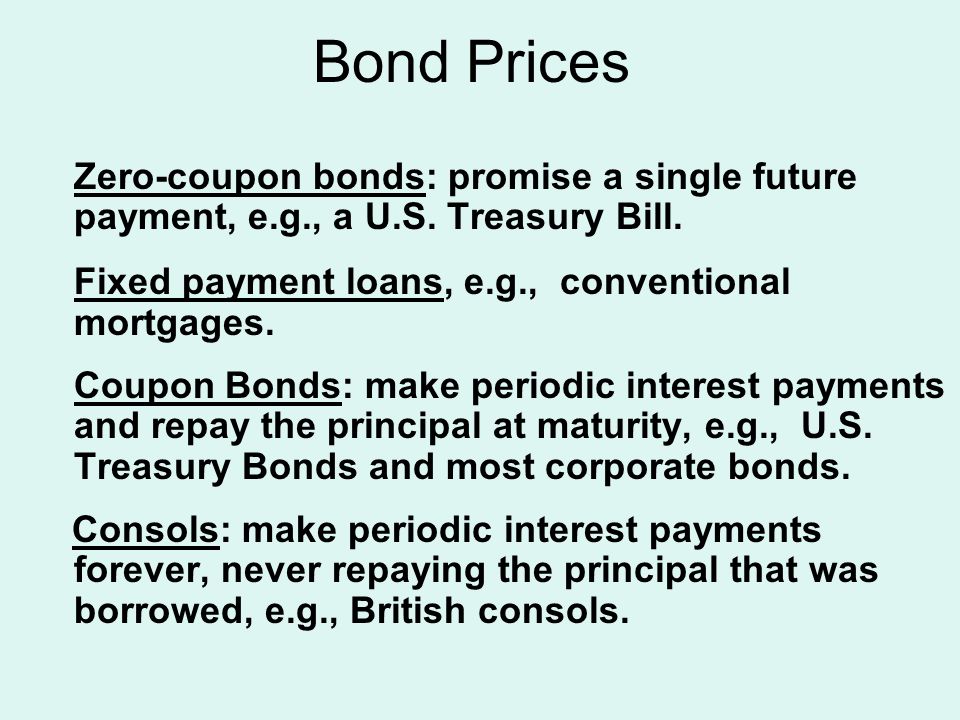

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different … Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals ...

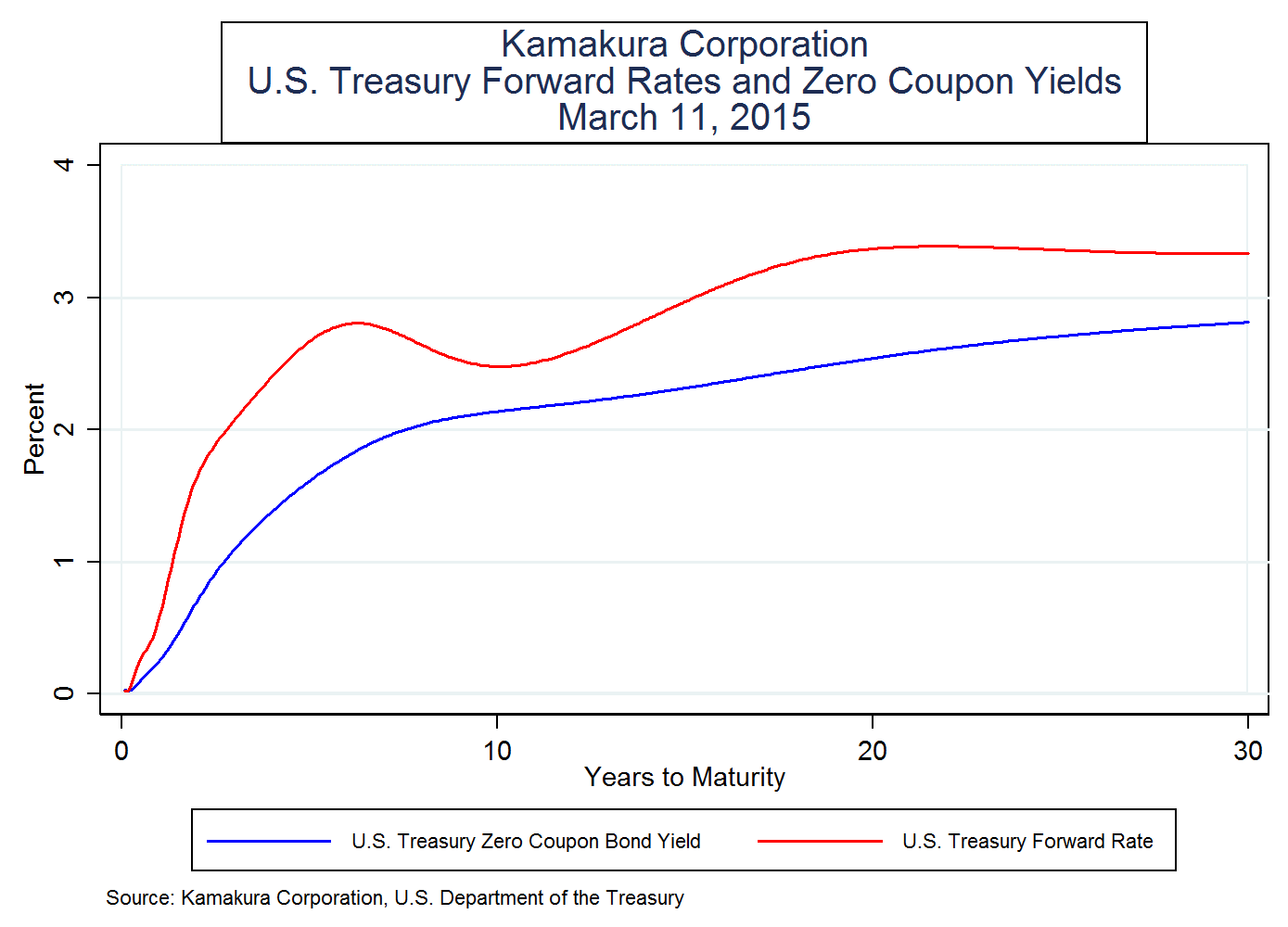

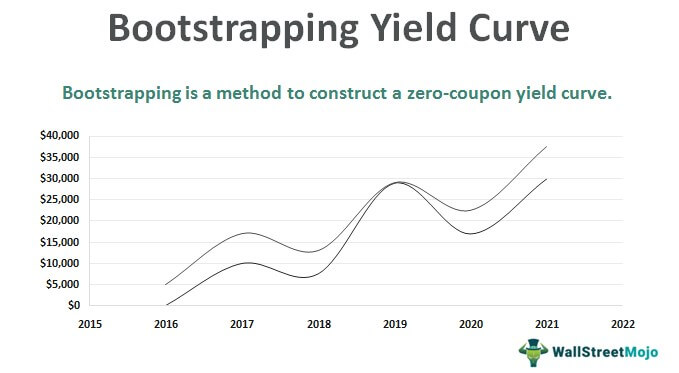

Treasury Yield: What It Is and Factors That Affect It May 25, 2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ...

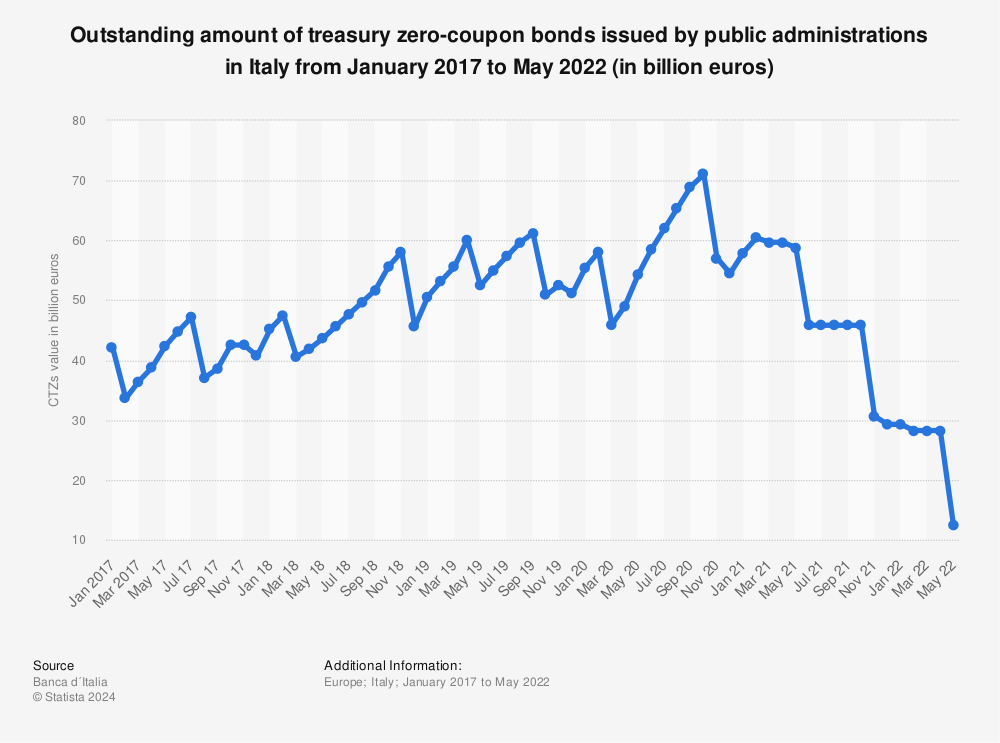

Treasury zero coupon bond

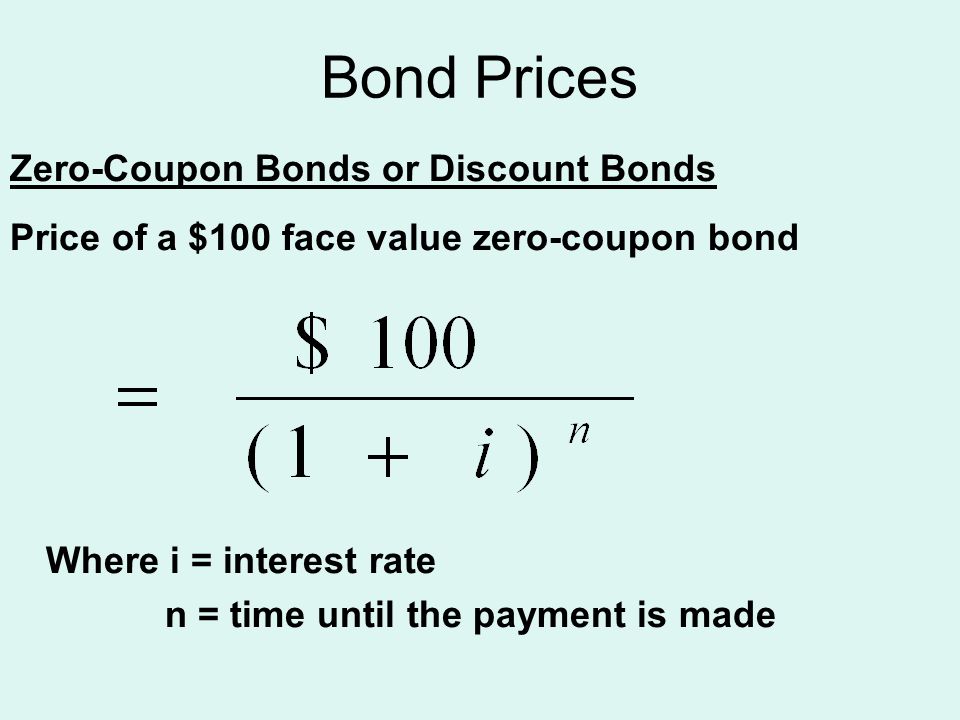

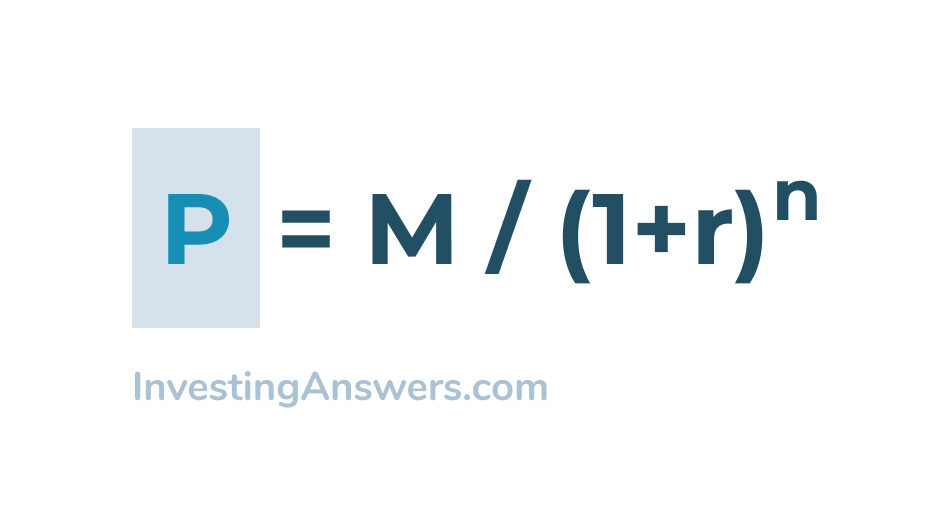

Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ... Government bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending. It generally includes a commitment to pay periodic interest , called coupon payments, and to repay the face value on the maturity date. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical ...

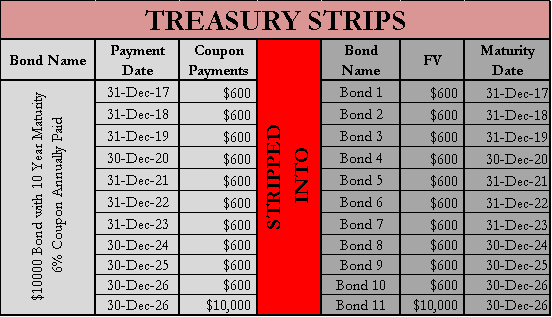

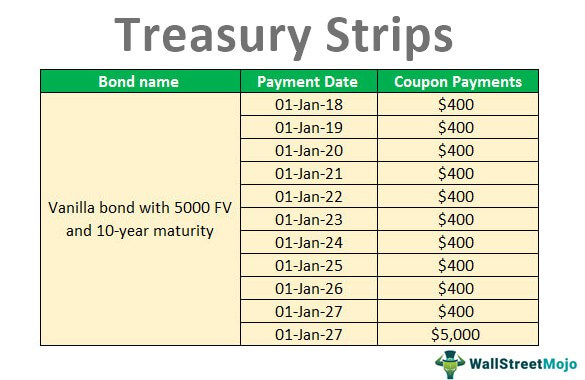

Treasury zero coupon bond. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are … Coupon Bond Vs. Zero Coupon Bond: What's the Difference? 31.08.2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. Treasury Bond (T-Bond) Definition - Investopedia 02.04.2022 · Treasury Bond - T-Bond: A Treasury bond (T-Bond) is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury bonds make interest payments semi ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds …

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF - ETF.com Oct 27, 2022 · Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news. United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

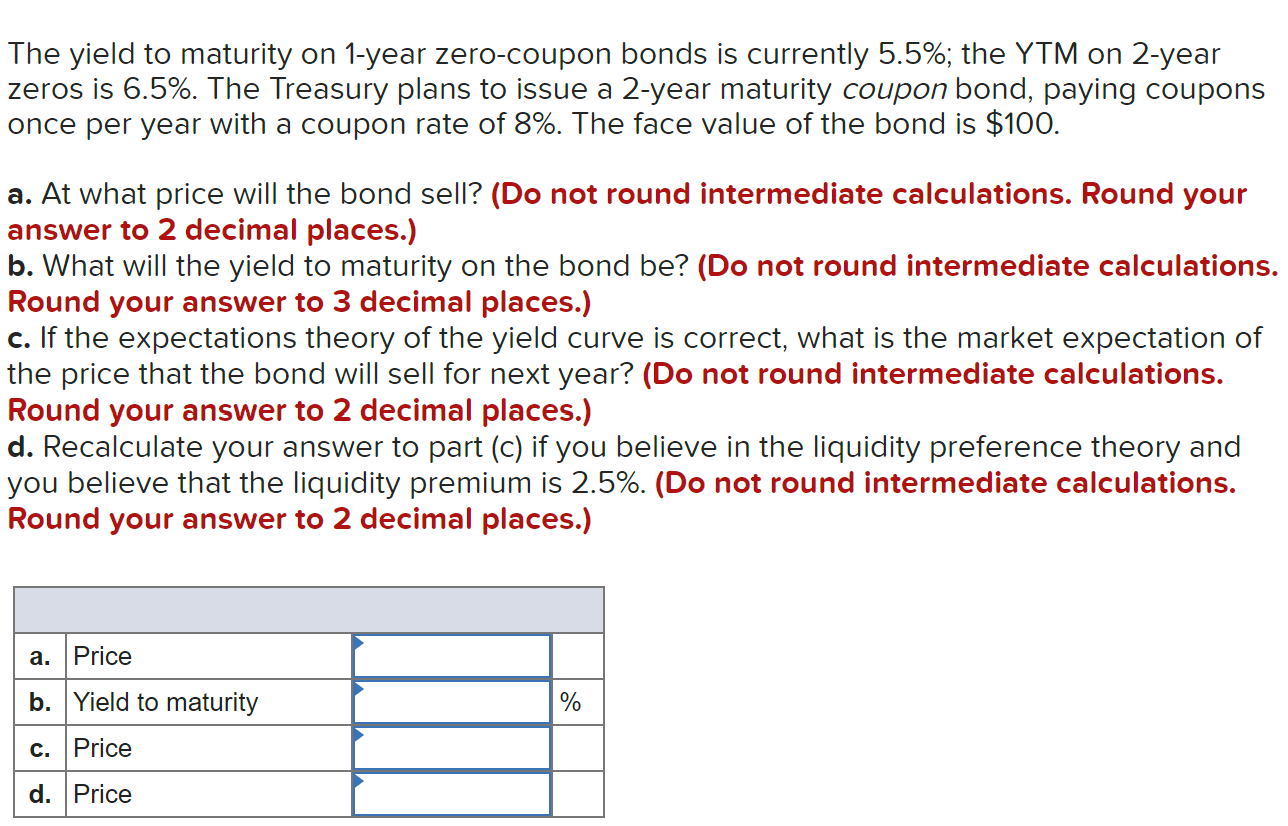

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical ... Government bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending. It generally includes a commitment to pay periodic interest , called coupon payments, and to repay the face value on the maturity date. Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ...

Post a Comment for "44 treasury zero coupon bond"