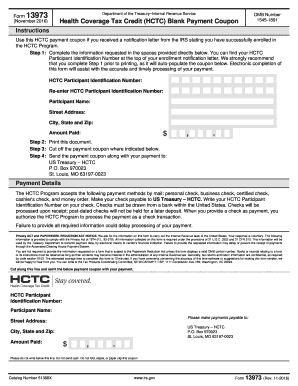

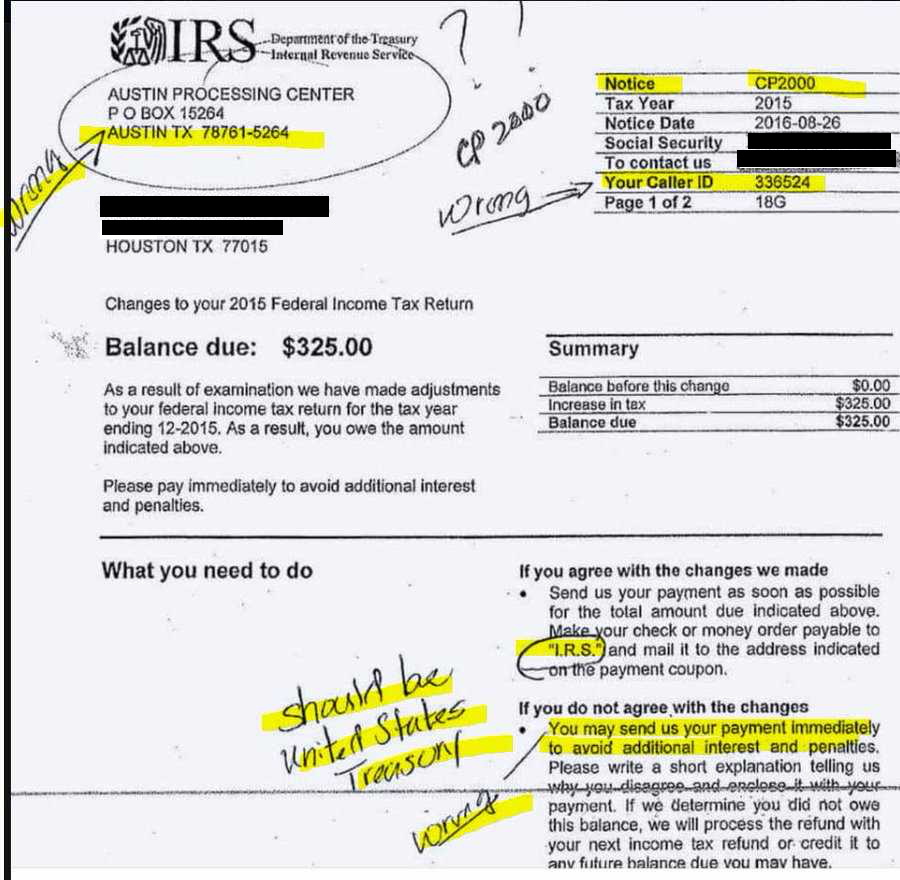

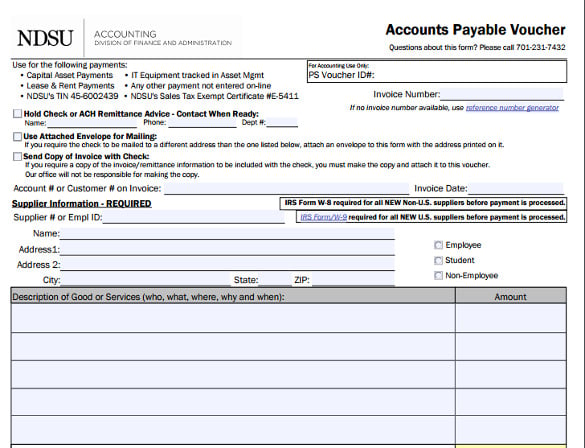

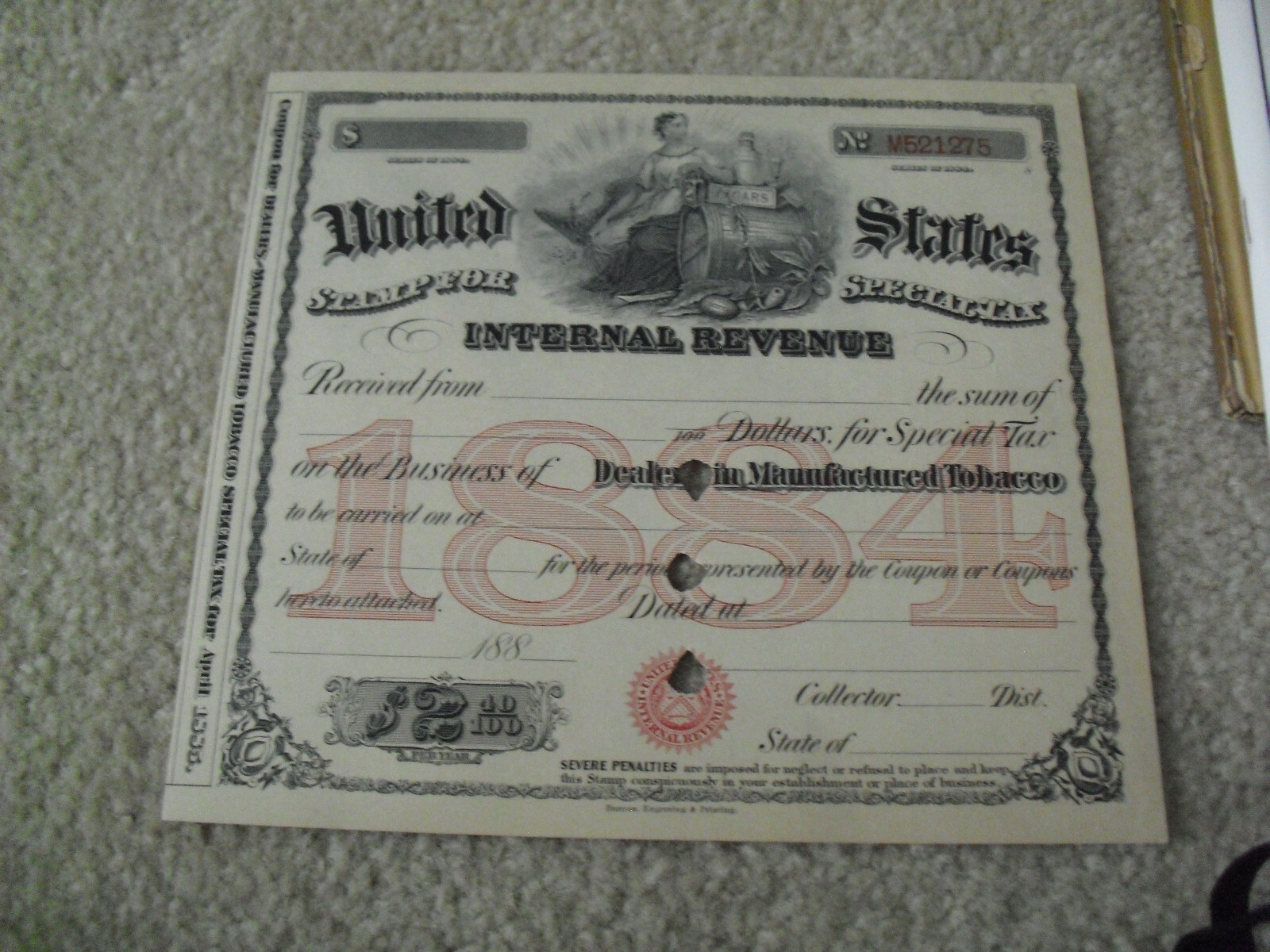

44 payment coupon for irs

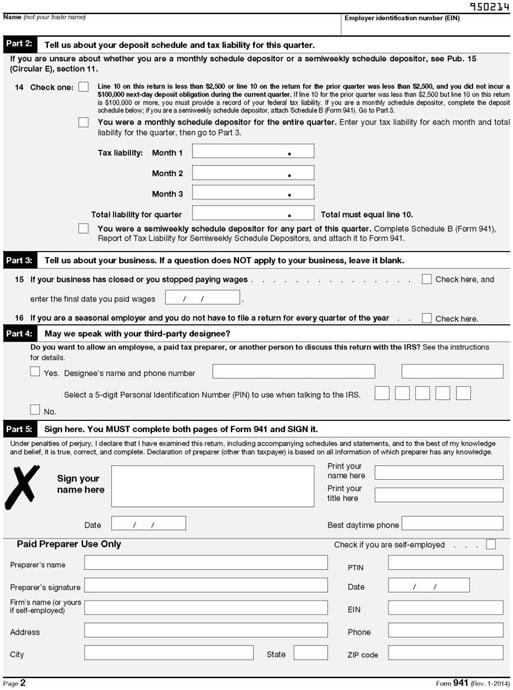

2022 Form 1040-ES (NR) - IRS Mar 1, 2022 ... You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and ... Paying a Balance Due (Lockbox) for Individuals - IRS The IRS uses lockboxes which are a collection and processing service provided by a network of financial institutions. Use your Form 1040-V, Payment Voucher.

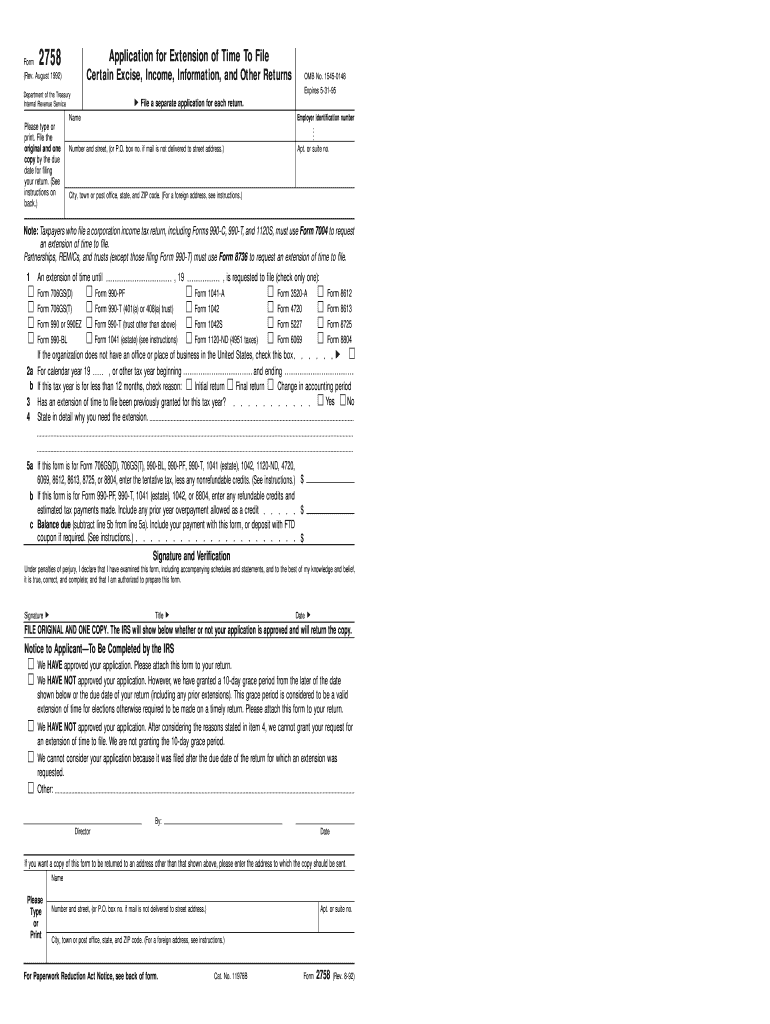

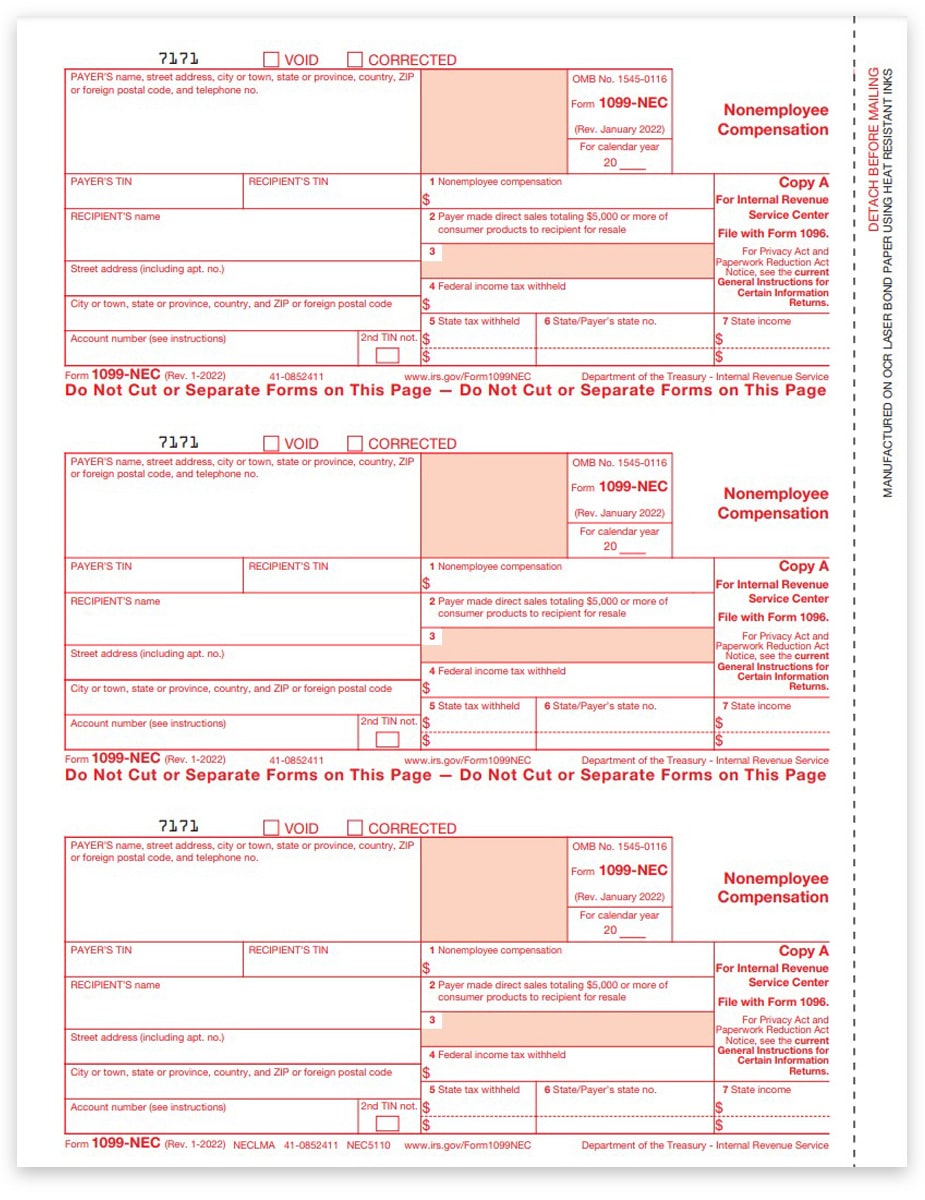

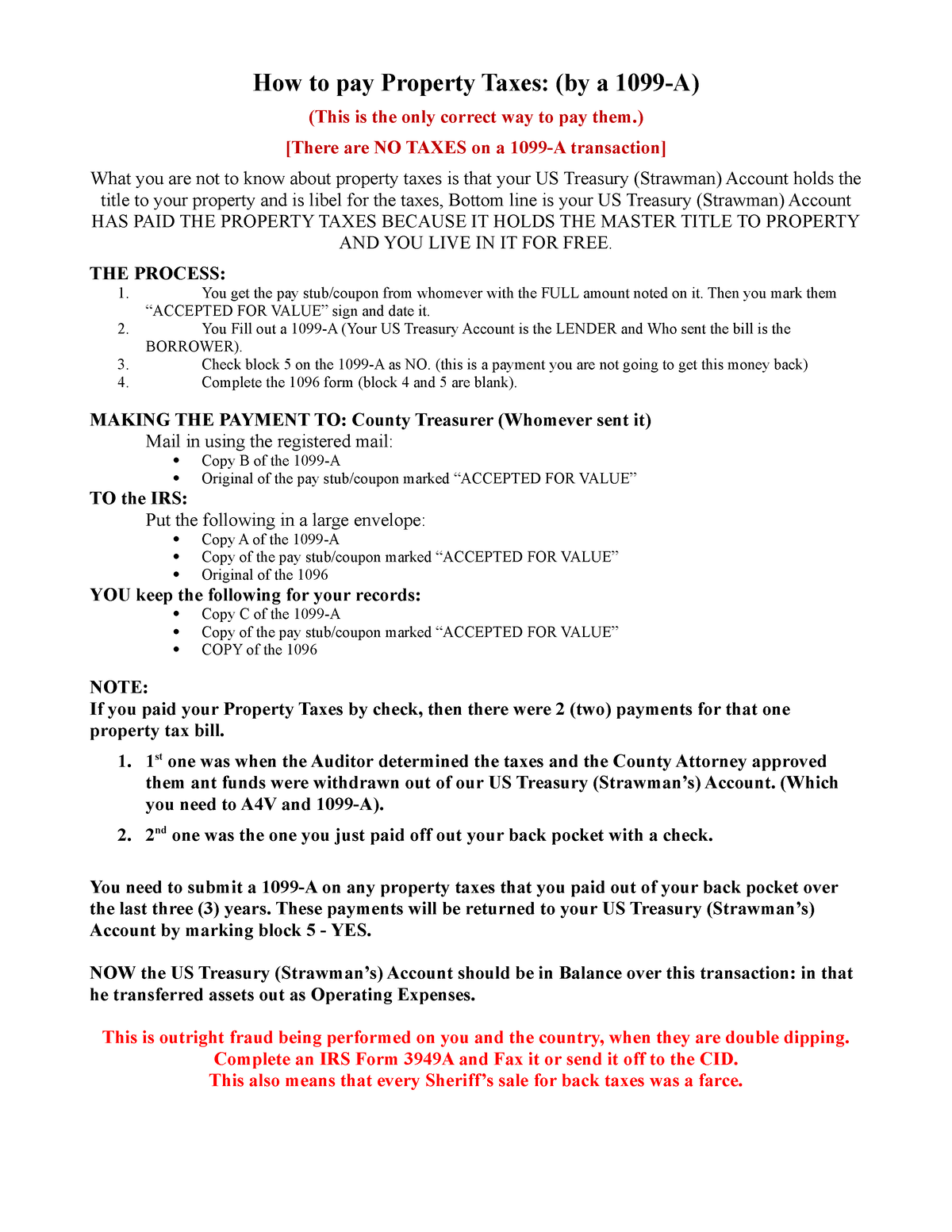

Instructions for Forms 1099-INT and 1099-OID (01/2022) Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ...

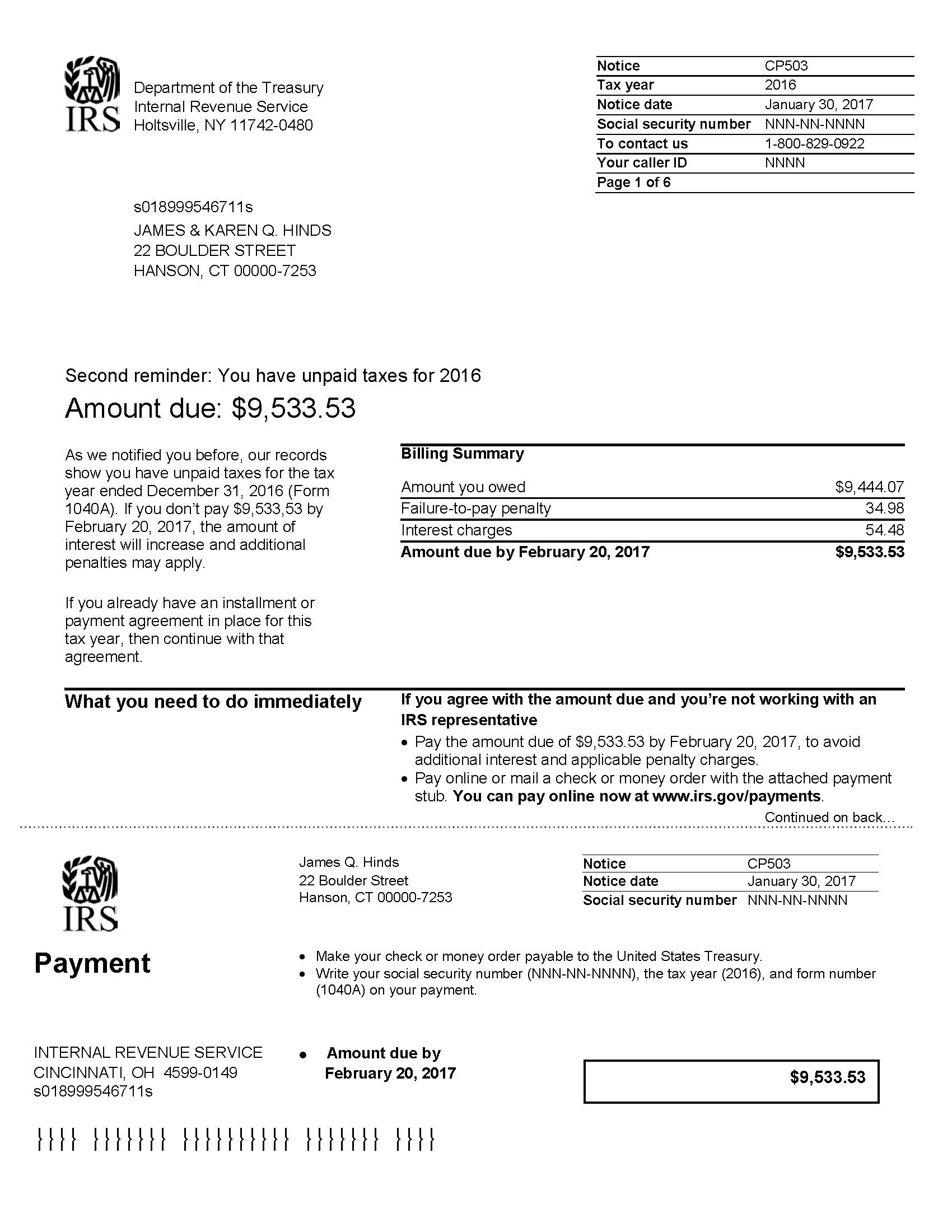

Payment coupon for irs

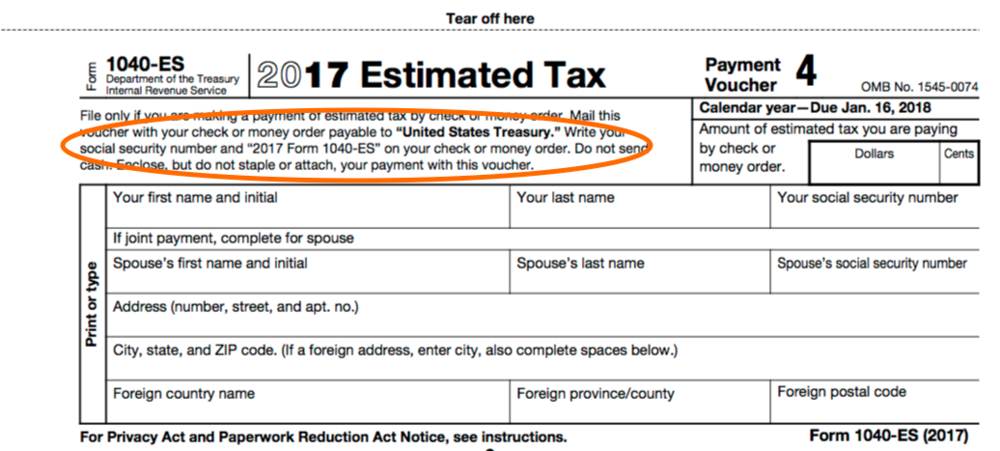

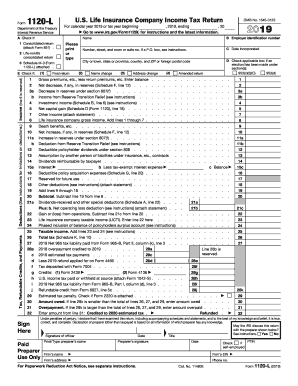

2022 Form 1040-ES - IRS Jan 24, 2022 ... You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and ... 2019 Form 1040-V - IRS Form 1040-V. Department of the Treasury. Internal Revenue Service (99). Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return. About Form 1040-V, Payment Voucher | Internal Revenue Service Aug 26, 2022 ... Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR ...

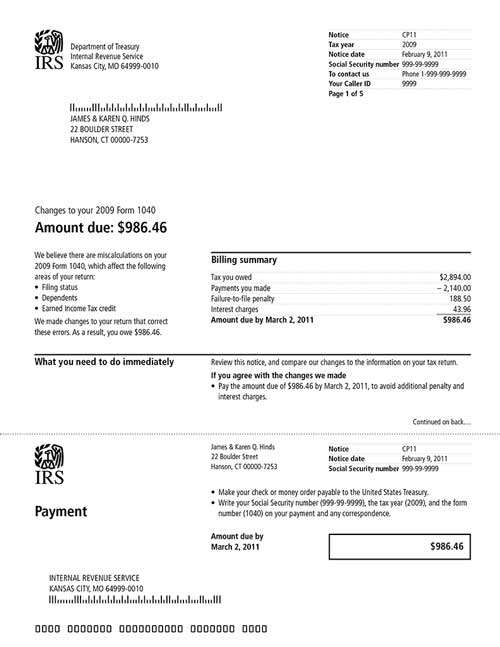

Payment coupon for irs. Three Ways to Reduce or Remove IRS Interest from Your Tax ... That’s why it’s critical to get into a payment agreement with the IRS: As your balance grows, so does the interest. So, it’s no surprise that people in this situation often ask the IRS to remove or reduce their interest. The IRS won’t remove interest most of the time – but if you’re proactive, you can minimize interest on your own. Prior Year Products - IRS Results 1 - 28 of 28 ... Title · Not sorted · Help on Title, Revision Date · Not sorted · Help on Revision Date. Form 1040-V, Payment Voucher, 2021. Form 1040-ES - 2021 - IRS You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and mail it with ... Penalty Relief due to First Time Abate or Other ... Aug 24, 2022 · Required to be shown on a return, but was not, and that tax was not paid by the date stated in the notice or demand for payment under IRC 6651(a)(3) Failure to Deposit – when the tax Was not deposited in the correct amount, within the prescribed time period, and/or in the required manner – IRC 6656

2021 Form 1040-V - IRS Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return. ▷ Go to for payment options and information. What Is the Minimum Monthly Payment for an IRS Installment ... Oct 16, 2021 · Fees for IRS installment plans. If you can pay off your balance within 120 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person. About Form 1040-ES, Estimated Tax for Individuals - IRS Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example ... It's Been A Few Years Since I Filed A Tax Return. Should I ... The IRS charges (or, “assesses”) a steep penalty for filing late. Add that to the penalty for paying late, and you’re adding as much as 25% to your tax bill. But if you file the returns and get into a payment agreement with the IRS (like a monthly payment plan or other arrangement), you’ll get reduced penalties

About Form 1041-V, Payment Voucher | Internal Revenue Service Aug 26, 2022 ... Information about Form 1041-V, Payment Voucher, including recent updates, related forms and instructions on how to file. IRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you. It’s the IRS calling…or is it? | Consumer Advice Mar 12, 2015 · The IRS won’t call out of the blue to ask for payment. IRS staff won’t demand a specific form of payment, and won’t leave a message threatening to sue you if you don’t pay right away. If you get a fake IRS call, report the call to the FTC and to TIGTA – include the phone number it came from, along with any details you have. About Form 1040-V, Payment Voucher | Internal Revenue Service Aug 26, 2022 ... Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR ...

2019 Form 1040-V - IRS Form 1040-V. Department of the Treasury. Internal Revenue Service (99). Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return.

2022 Form 1040-ES - IRS Jan 24, 2022 ... You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and ...

Post a Comment for "44 payment coupon for irs"