40 duration of a coupon bond

9 Best Short-Term Bond Funds - US News Money Find the top rated Short-Term Bond Funds. Find the right Short-Term Bond for you with US News' Best Fit ETF ranking and research tools. Macaulay Duration - Investopedia A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In...

How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

Duration of a coupon bond

How Bond Maturity Works | Bonds | US News 12.03.2020 · A general rule of thumb, Zox says, is if a bond's duration is five years, and interest rates increase by 1%, the price of the bond would be … What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Macaulay's Duration | Formula | Example - XPLAIND.com Bond A: $1,000 face value coupon bond with 4 and half years till maturity. Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value.

Duration of a coupon bond. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Bond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. Simply enter the following values in the calculator: Duration | Definition & Examples | InvestingAnswers The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds - which have only one cash flow - have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. Duration Definition - Investopedia Nov 11, 2021 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

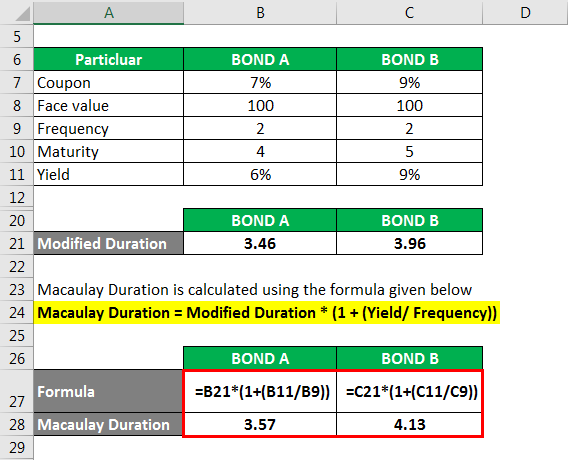

What is the duration of a bond? and How to Calculate It? The model calculates the time the present value of cash flows from a bond takes to realize. The simplified formula for Macaulay duration is as below: Macaulay Duration = Sum of PV of cash flows [PV (CF 1) + PV (CF 2) … + PV (CF n )] / Market price of the bond See also Mortgage - Usages and How It Work Duration Formula (Definition, Excel Examples) | Calculate ... Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. What is the duration of a bond? and How to Calculate It? Duration of a Bond. The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as … Macaulay Duration - Overview, How To Calculate, Factors How to Calculate Macaulay Duration. In Macaulay duration, the time is weighted by the percentage of the present value of each cash flow to the market price. Bond Pricing Bond pricing is the science of calculating a bond's issue price based on the coupon, par value, yield and term to maturity. Bond pricing allows investors.

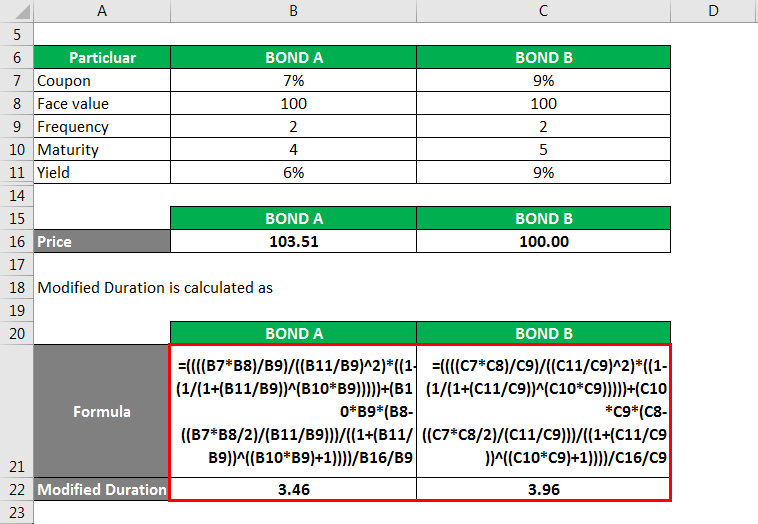

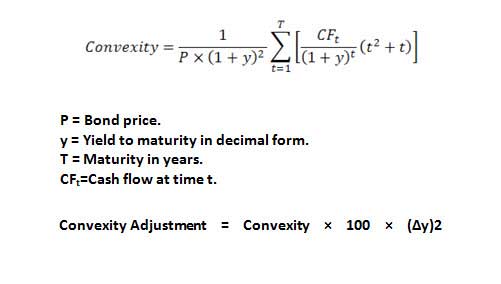

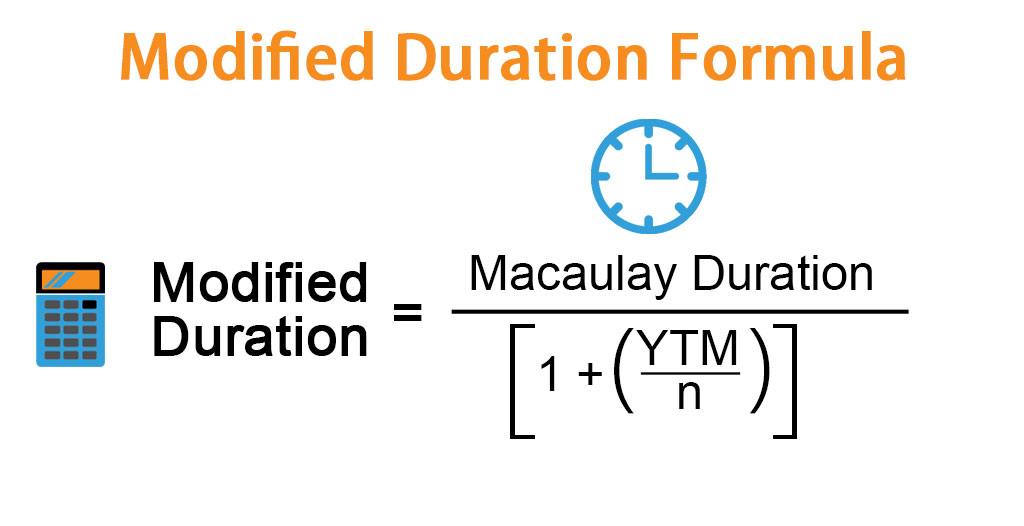

Modified Duration Definition - Investopedia 12.02.2022 · Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates. … Convexity of a Bond | Formula | Duration | Calculation For a Bond of Face Value USD1,000 with a semi-annual coupon of 8.0% and a yield of 10% and 6 years to maturity and a present price of 911.37, the duration is 4.82 years, the modified duration is 4.59, and the calculation for Convexity would be: How to Calculate Bond Duration - wikiHow To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder). Understanding bond duration - Education | BlackRock Conversely, if a bond has a duration of five years and interest rates fall by 1%, the bond's price will increase by approximately 5%. Understanding duration is particularly important for those who are planning on selling their bonds prior to maturity. If you purchase a 10-year bond that yields 4% for $1,000, you will still receive $40 dollars ...

Bond Duration | Formula | Excel | Example - XPLAIND.com Example. On 14 November 2017, you added the three bonds to your company's investment portfolios: (a) a $1,000 zero-coupon bond yielding 5.1% to maturity which is 31 December 2020, (b) a $100 face-value 6% semi-annual bond maturing on 30 June 2023 and yielding 4.8% and (c) a $1,000 face value 5.5% semi-annual bond maturing on 30 June 2023 and ...

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of...

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ This tool calculates the market price of a zero coupon bond of a certain duration. Enter par or face value and duration to see price, and learn the formula. ... A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

Modified Duration - Overview, Formula, How To Interpret Below is an example of calculating Macaulay duration on a bond. Example of Macaulay Duration. Tim holds a 5-year bond with a face value of $1,000 and an annual coupon rate of 5%. The current rate of interest is 7%, and Tim would like to determine the Macaulay duration of the bond. The calculation is given below: The Macaulay duration for the 5 ...

What Is Duration of a Bond? - TheStreet Definition - TheStreet Mar 22, 2022 · When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds. In a nutshell, the general rule is that for every 1% increase in interest rates ...

Bond Duration Calculator – Macaulay and Modified Duration - DQYDJ Coupon Payment Frequency - How often the bond pays interest per year. Calculator Outputs Yield to Maturity (%): The yield until the bond matures, as computed by the tool. See the yield to maturity calculator for more details. Macaulay Duration (Years) - The weighted average time (in years) for the bond's cash flows to pay out.

Duration - Definition, Types (Macaulay, Modified, Effective) What is Duration? Duration is one of the fundamental characteristics of a fixed-income security (e.g., a bond) alongside maturity, yield, coupon, and call features. It is a tool used in the assessment of the price volatility of a fixed-income security.

Bond duration - Wikipedia For example, a standard ten-year coupon bond will have a Macaulay duration of somewhat but not dramatically less than 10 years and from this, we can infer that the modified duration (price sensitivity) will also be somewhat but not dramatically less than 10%.

Duration: Understanding the Relationship Between Bond Prices ... That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date.

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Dollar Duration - Overview, Bond Risks, and Formulas Dollar Duration. The change in the price of the bond for every 100 bps (basis points) of change in the interest rate. Updated August 31, 2021. ... It means that as interest rates fall, bond coupon rates increase. Short-term bonds are less sensitive to interest changes, while a 20-year long-term bond may be more sensitive to interest rate ...

Coupon Definition - Investopedia 02.04.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Macaulay's Duration | Formula | Example - XPLAIND.com Bond A: $1,000 face value coupon bond with 4 and half years till maturity. Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value.

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

Post a Comment for "40 duration of a coupon bond"